Today I met someone, a small boy of 9 Years. He is very naughty, but very intelligent. He has a younger brother, his name is Tavgun Singh. Tavgun Singh and Ekasveer Singh love each other a lot.

‘Lucky’ Modi Government

India is a land of democracy. Post Independence India is being governed by 2 political parties, namely Congress & BJP and majorly ruled by Congress. India had recent elections in 2014, where BJP was elected with exceptional majority and whole hearted efforts of their brand ambassador and elected Prime minister Mr. Narendra Modi. Before 2014, Congress was in power for 10 years, with a clean, non political, silent and smart economist Prime minister Mr. Manmohan Singh.

During the second tenure of ex-PM Mr.Manmohan Singh there were global economic crisis and basic commodities like crude oil & gold were showing extraordinary rise in prices where as Rupee as a currency fell sharply. Crude oil was trading around $140 per barrel. India imports crude on a large scale as a necessity & Indians have an extraordinary love for Gold. The import bills of gold touched a record high during this period. This created a huge mismatch between imports and exports (current account deficit) for an import oriented economy like India.

To manage this Government planned to pass on the price hike in crude to the end consumer (earlier petrol and diesel were subsidised) and imposed excise/import duty on gold. Petrol shot up above 75 (when crude shot up to $140) and daily need got expensive giving rise to overall inflation. They also introduced revolutionary Adhaar Card (Unique Identification number) for the citizens which is a biometric ID with linking to your PAN & bank accounts in order to pass on the subsidiary benefits to actual needy people. Mr. Singh created a shield to defend all these issues and protect the Indian economy which was then opposed by a lot of people sitting in opposition.

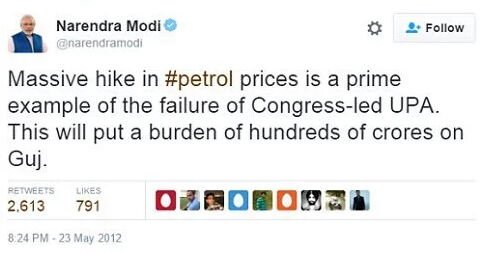

Mr. Modi using petrol price hike by Mr. Singh as his prime marketing tool.

Personally, I am a politically neutral person. I would like to appreciate the good work. I would definitely appreciate the marketing campaigns done by Mr. Modi ji pre and post elections.

Soon after elections, the price of crude started falling, gold prices and global economies began to settle. Today crude oil is hovering around $ 50 where as petrol price is around Rs. 67/-.

Now just imagine the crude oil prices running back to $120-140. Now, that would give us shivers!

Mr. Modi was right politically at that time. But over a period of time, he understood the sense of removing the subsidiaries from petrol and diesel by Congress or probably he used that as His marketing tool.

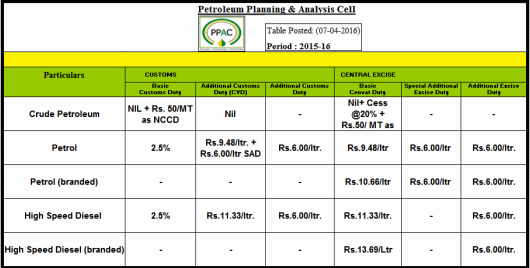

Mr. Singh was logically correct at that time. But what about the taxes being raised by BJP? Let us have a look at current taxes on petroleum.

Current Excise and Custom duties charged by the Current Central Government.

Current Sales Tax charged by the State Governments

Adhaar initiative by previous Govt. shall be a big advantage for all the future governments and obviously the current one also, which would result in big savings in subsidiary expense to the country. There has not been a major rollback on the import excise on gold. Additionally there is a hike in service tax from 12% to 15% and is further expected to rise to 18% (GST).

Where are all the savings going?

The salaries of all the government employees has gone up with an expectation that this might make them uncorrupt and be loyal public servants.

The money saved in petroleum is huge, and is used for infrastructural development of the country which is a desperate need. Dream projects of ministers are being proposed and stream lined.

The economically weaker sector is supported, trade deficits are reducing, energising defence, Swatch Bharat Abhiyaan, funding PMs’ foreign trips (apparent attempt to boost the FDI) and other social and required expenses.

Moving on. What does it mean for ME? That’s what matters.

The common man is paying huge taxes on every thing. Service tax, sales tax, income tax and many under direct & indirect taxes. All this is said to be used for the safety and upliftment of common man. Trust me the global economies are not in the good shape, but India stands far better. Lots of governing process getting online reducing the agents an bribing culture from RTO’s, Shop Act offices and many others, which is though savings for common people like us.I though sympathise the agents who used to live on the agent fees through these centres but both e-governance & digital india are playing crucial roles. The overall structure is moving towards positive ,online and bribe free environment. As a end user, railways and infrastructure for transport is improving. Business environment getting healthier. Opportunities in both public and private sector jobs have increased which has given rise in incomes of individuals.

God had blessed India with the most educated PM Mr. Singh who has a history of revolutionary thoughts and executing the same. (He was one of the three (Mr.P.Chidambram & Mr. Ahluwalia being other 2) core person to lead India to the path of globalisation. It was during his period the scope of mobiles started and was able to reach a common man.) And now, God has gifted Mr. Modi who is aggressive, and has proven him self a good marketer and executor for futuristic norms. With an extraordinary luck of global factors along with crude and gold prices settling soon after him coming to power I would personally expect a lot from him in times to come.

With this sequence, accepting the fact the prices for us rising, lets hope India being one of the prime place to live & invest.

contributed & edited by Aminder Singh

Investments

Investment was generally considered as a Rich-Man concept, where a person puts in the money and nurtures it for a dynamic returns. Hence investment is a concept which means making money out of money or wealth creation. The core ingredients in any kind of investments are knowledge, time and patience along with resources. The correct combination of these ingredients lead to wealth creation.

For a common man, investment generally means investing in bullion (gold), fixed income, real-estate and other such traditional instruments. A common man is basically concerned about his day to day needs and upcoming short term expenses. With a limited exposure in financial inflow, it is quite difficult for a person to makeup for the more than average expense in the short run. So, we never thing of investing in equity or stocks or capital markets. Investing in these assets can be slightly risky, but if invested logically these investments pay off handsomely. If invested in a correct asset class with diversification in a disciplined manner, patience will pay off the volatility with dynamic returns.

Most of the expenses are something which are unavoidable by nature as in house renovation, child education, old age medical etc., It is better to term it at goals, rather than expenses. If these goals are pre decided and a small amount of funds are invested in a proper manner on regular basis, then the heat these expenses is not felt and there is no fire-fighting on the last moment.

The core is take a note of your goals (with the help of a professional) and work towards it.

How does Quantitative Easing (QE) affect the markets ?

The recent statement by Ben Bernanke, Chief of Federal Reserve (USA), had led to massive fall in the commodity prices, equity markets, precious metals and huge volatility in the bonds market and currencies. On Wednesday, 19 June 2013, Uncle Ben announced a “tapering” of some of its QE policies contingent upon continued positive economic data and improving unemployment data in the USA.

What is Quantitative Easing (QE)?

First let us understand QE.

Definition of ‘Quantitative Easing’

A government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital, in an effort to promote increased lending and liquidity.

This means, an additional supply of money (Currency) is infused in the system. This money is given (not lend) at a 0% interest or at a negligible interest to the financial institutions by the central bank. These financial institutions further give this money to the stressed business houses to sustain the downfall in the economy.

Food Security Bill :: Nomura

The overall fiscal and inflationary consequences of the Food Security Bill for the country are “large” and will become clear from the next fiscal year, a report by Nomura Holdings said.

The government yesterday decided to issue an ordinance to give two-thirds of the population the right to get 5 kgs of foodgrains every month at subsidised rates of Rs 1-3 per kg.

“While this bill is justifiable on welfare grounds, the macroeconomic implications of the bill are quite significant,” Nomura economist Sonal Varma said in the report.

“India’s current macroeconomic position does not provide the space to implement this policy,” Varma added.

The global brokerage firm noted the bill would not have a substantial impact in the current financial year (FY13-14) as it is likely to be implemented in phases and three months of the fiscal year have already passed.

“However, the medium-term consequences of the bill could be far reaching and will be clear from FY15 onwards,” Nomura said.

The government plans to spend Rs 1,25,000 crore every year to supply 62 million tonnes of rice, wheat and coarse cereals through the public distribution system.

According to Nomura, the bill would raise the government’s food subsidy burden to an estimated 1.0-1.2 per cent of GDP per annum from 0.8 per cent currently. There would also be additional expenses on creating the infrastructure needed to implement the Food Security Bill.

In case of a deficient monsoon, the country may need to import grains, which could send global foodgrain prices higher. As the government would procure a substantial part of the domestic foodgrain production, there would be a scarcity for the private sector, which in turn would push prices higher.

Consumption demand for other items would rise as a lower amount of disposable income would need to be spent on grains.

“Therefore, the overall fiscal and inflationary consequences of the Food Security Bill are large,” Nomura said.

Why Petrol & Diesel Price in India Rise Despite of Crude Oil Price fall Globally?

First the good news!

International Crude Prices have been coming down.

And then the bad news!

The price of both petrol and diesel have risen despite falling international prices.

Sounds weird. Isn’t it? In fact seems a bit too unfair.

This can be true because the price that we pay for petrol depends on two factors..

1) International Price

2) Value of Rupee.

The first factor is easy to explain. Higher international prices mean higher local prices. Similarly lower international prices mean lower local prices. It’s a simple and direct relationship.

However, the second factor which is about higher local prices because of weakening currency is what I thought would be good to explain.

Let’s assume the price of Petrol is $100 per unit and the exchange rate is Rs. 50 per dollar.

Then the cost of Petrol in rupees would be = 50 x 100 = Rs. 5000.

Now, assume that the exchange rate changes to Rs. 60 per dollar.

Now although the price of Petrol in the international market continues to be $100 per unit, but because of the change in exchange rate, the cost for India for a unit of Petrol goes up from Rs. 5000 to Rs. 6000 (60 x 100 = Rs. 6000).

That is a 20% increase in price (Rs. 6000- Rs. 5000/Rs. 5000) x 100 despite no change in International Prices.

Even if the price of Petrol were to reduce to $95 per unit, it would still cost India Rs. 60 x 95 = Rs. 5700 which is more than what India was paying when Petrol cost $100 at Rs. 50 per dollar exchange rate.

Thus it is possible for us to pay more for Petrol even if the International Price of Petrol were to come down.

This is because of currency weakening (rupee vis a vis the dollar) at a rate faster than the fall in International price of Petrol.

Hope this story has clarified why Price of Petrol could rise in India even if International Price of Petrol were to reduce.

Investment Recipe with Current Scenario.

Uncle Ben (Federal Reserve, US) has indicated that if the recovery in the US economy does continue its improvement, the stimulus will reduce towards the end of this year, and possibly stop in the middle of the next year. So the huge liquidity flow in the markets will reduce. A common sense is that, the stimulus package cannot last forever, and the fact that the US economy is recovering is a positive. However this announcement resulted in a global sell off, including currencies, oil and gold, and the money was put into the dollar and treasuries, where the 10 year yield moved up from 1.75% to about 2.7%. All were DISLIKED by the markets.

In India we have an another set of problems, namely a huge current account deficit (CAD) and the weakening rupee. This has therefore reduced the returns of the Foriegn Investors (FIIs). They had made a large profit in the bond markets and hence some profits were booked and this supply resulted in the fall in the bond prices and also pushing the rupee southwards. Although oil prices have also fallen, it will not improve the CAD due to the fallen rupee. In the near term it is going to be difficult to cut interest rates for the following reasons:

1. Food inflation is on the higher side.

2. CAD will widen as the rupee weakens which will affect the fundamental of the economy and FII flows

3. Will need the interest rates to be on the higher side to attract dollars,but it would have are reverse effect on the economy too.

1. Faith in the corporates & business.

2. Discipline

3 Patience

4. Asset allocation

5. Diversification within the asset class

6. Rebalancing.

Currently, capital markets are trading at the PE of 16 times and the average has being 19.5 times.This means, there is huge scope of market appreciation there from these levels. This does not mean parking all the money in equities. This time is for rebalancing and systematic investments in equities. Increase the portfolios of equities, have a decent exposure in debt and have patience. This is an essence of successful investments.

Networth Report

What is a net worth report in personal finance ?

Is it the net holdings of your investmets of a individual ?

Just like balance sheet, net worth report is the difference of net assets (investments) less net liabilities (loans, debts) in the world of investments. Ideally I would prefer to take real estate at 80% of the market value I.e., would prefer to discount it by 20% of the market value to get the liquidity instantly. I would rather add 3% of the outstanding loan amount as prepayment charges to got the net worth of my investments.The above adjustments are made considering instant liquidity of the instrument. Never consider your residence as your asset. We can never value our residence in money, untill we have a replacement.

The reason for considering real estate @ 80% of the market value is for instant liquidity. Normally, a investor wants to get the best price for his investment I.e, if the market value is Rs.100 the investor wants Rs. 102, 105 or even 110 as its worth. In this case the asset is not sold instantly. It take a longer time for his investment to be liquidate or to be converted to cash. If you find the same asset of Rs. 100 at Rs. 98 or 95 or at 90 it will be a grab for investors. Which means, the liquidity is instant. Better than expected money will make me happy, so 80% of the value gives me a comfort zone. Same stands with the loans and debt part of my profile. If we save more than we calculate is like a cherry on the top.

Achievers

“What the mind of man can Conceive and Believe, it can Achieve.” – Napoleon Hill